Expert Advice. The Best Mortgage Solutions.

Helping You Build Wealth Through Real Estate.

WELCOME TO SYNERGY MORTGAGE GROUP

Whether it is purchasing a home, a rental, vacation property or consolidating debt,

my goal is to provide you with the best possible solution tailored to your specific needs.

JOSH PEREZ

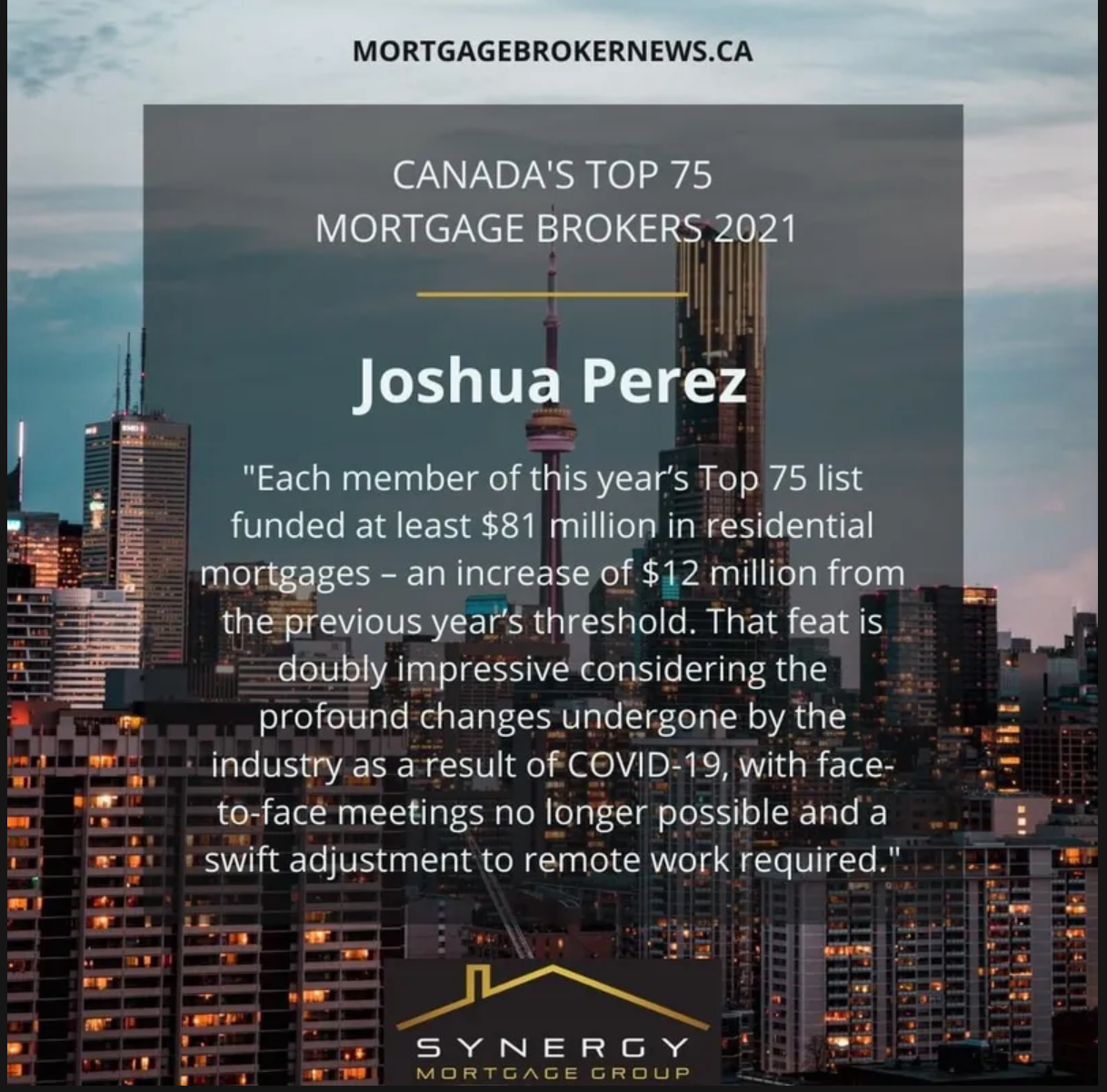

Josh Perez is the Principal Broker and Partner at Synergy Mortgage Group. He started working at a big bank in 2009 becoming a Financial Advisor before transitioning to a Mortgage Broker in 2015. He's been recognized in Canadian Mortgage Professional's Top 75 Brokers in Canada in each of the last 3 years. His brokerage, Synergy Mortgage Group, which officially launched in 2020, was nominated for Top New Mortgage Brokerage of the Year and has funded over a billion in mortgage volume in the last two years. Josh with his team at Synergy and access to 60+ lender partners, is committed to providing expert advice and the best mortgage solutions.

Josh is also actively involved in real estate investing and presently owns 150+ doors spanning residential and commercial property, mainly in Ontario with a few active projects in Southwest Florida and Alberta. He started his investing journey in 2010 and is a big advocate of helping his clients, partners and inner circle build wealth through real estate and educating them on how it can help them accelerate reaching their financial goals.

Nice things people have said about working with me.

Videos To Keep You Informed

Get started by scheduling a

5 - 10 minute intro call

I'll let you know exactly where you stand so you can proceed with confidence.

Go ahead and schedule a meeting with me!

Services

-

Mortgage Solutions

First-Time Home Buyers

Rentals

Commercial Properties

Consumer Proposals

Cashback

Purchase+Improvements

New Builds

-

Private Lending & Refinancing

Renovations

Debt Consolodation

Investing

Home Equity Line of Credit

Down Payment Towards Another Purchase

Short-Term Loan/Temporary Situations

First and Second Mortgages

New Paragraph

Mortgage articles to keep you informed

Video's To Help You Invest, Buy, Sell, And Save!

Everything you need,

all in one place

As a trusted mortgage provider, let me help you with these services.

Click through any of the services to learn more